Government Programs

Living in Calgary, Alberta there were no municipal or provincial government programs available when I was looking into installing solar. Luckily for me the Government of Canada decided to launch a Greener Homes Grant through NRCAN. It is always nice of the government to bribe me with my own tax dollars!

Wit this grant you can get up to $5000 of home retrofits and the cost of a home energy assessment up to $600. You have to get an initial home assessment done (before work begins) and then after the work is completed.

For interest there a provincial program for municipalities here.

Getting the grant

Nothing dealing with the government is easy. I had a hard time finding a solar energy assessor, and while I received a tracking number after applying that was it.

Eventually I did get an assessment which I will provide in another post, however, never heard boo from NRCAN. I did call the 1-800 number which was especially useless. I said I applied about 5 months ago and haven’t heard anything. The answer was they couldn’t see the status of my application. I asked why the site says most people hear in weeks not months; the response was we can’t see anything. I mean why have a 1-800 number if the agents have no visibility to anything?

After nearly 6 months my application was finally approved, after the solar already installed. Now I just have to get a final energy audit.

Financial Analysis

I love Excel. It can do all sorts of great things, like estimate how long a solar system will take to pay off.

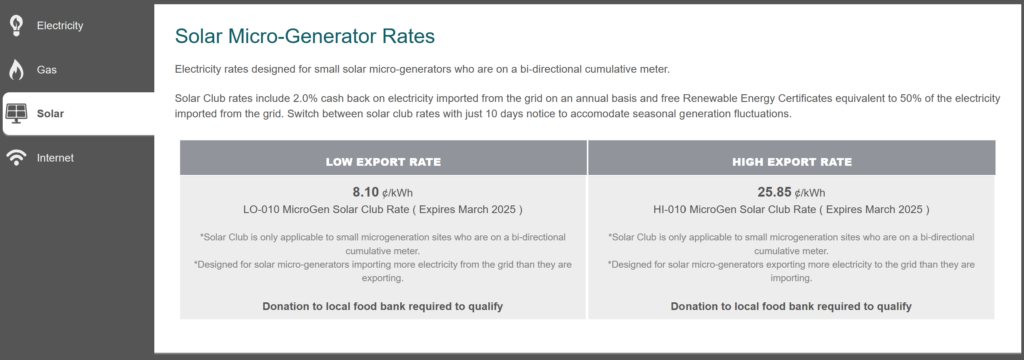

I had a couple of payback estimates from the folks that originally gave me quotes. Both seemed to say payback was about 9 – 13 years. This was primarily due to Solar Clubs and bi-directional metering. Essentially you can get a higher rate while you are producing more solar than you are consuming. The rate was about 26 cents a kWh so material. The bigger the system the quicker the payback if you are over 100%.

My big model error

While the solar rate is great, I made a fundamental error in my model. When calculating the value of my power I included the variable distribution costs. So in my system I assumed a total power cost of 13 cents, of which 7 was variable energy costs and 6 was distribution. This is true for power I consume, HOWEVER, it is not true for power I push to the system. I only get credit for the production (7 cents in this example). This was materially less than I had modelled, so my payback will be longer than expected.

I should note that both of the companies that provided financial models made this same assumption so were certainly showing an accelerated payback.

Distribution Cost Avoidance

Given how much the monthly fixed and variable distribution costs are (generally significantly more than the actual energy costs) I wanted to avoid them as much as possible. The way we have been doing that after discovering the model issue above is to use our high energy devices in the daytime. For example we used to run our dishwasher at night, but it would make far more sense to run it during the day when we had solar production. The difference is about 6 cents a kWh of variable distribution charges – nearly as valuable as the actual power!